Credit Card Processing

Retail Face-to-Face

Mail Order Telephone Order

eCommerce Internet Sales

eMail Invoicing

FedNow & Real-Time

Payments

Solutions

Online integrated Origination, Sending, Receiving and Recordation of all Good Funds Transfers.

"All participants receive instant real-time electronic notifications. Use our online Payment Gateway interface or integrate your in-house system with our API"

More infoCheck Processing

Online Reporting with Images

Stop Going to the Bank

Next Day Funding

Check 21 - Remotely Create Checks

Electronic Check

Instant FedNow® vs. Credit Card Processing: The Future of Instant Payments

Introduction: Instant FedNow® as a Credit Card Alternative

The way businesses and consumers make payments is rapidly evolving. While credit cards have long been a go-to payment method, they come with high fees, chargebacks, and settlement delays. Instant FedNow®, developed by the Federal Reserve, offers real-time, 24/7 payments with no intermediaries, no chargebacks, and instant fund availability—making it a superior alternative to traditional credit card processing.

This article explores how Instant FedNow® compares to credit card processing in terms of transaction speed, cost, security, and business efficiency, and why businesses should consider switching to real-time, bank-to-bank payments.

Instant FedNow for your business using Real-Time Payments

1) Speed: Instant FedNow® vs. Credit Card Settlement Delays

One of the biggest drawbacks of credit card payments is the delayed settlement process. When a customer makes a credit card payment:

- The authorization process begins with the card network (Visa, Mastercard, etc.).

- The merchant’s bank requests funds from the issuing bank.

- The payment is pending for 1-3 days before settling into the merchant’s account.

With

Instant FedNow®, this delay is

eliminated. Payments are:

✅ Processed in

real-time, with funds available immediately.

✅

Not dependent on card networks or third-party processors.

✅ Accessible 24/7/365, unlike credit cards,

which rely on batch processing.

For businesses that require faster liquidity, such as freelancers, service providers, and e-commerce merchants, Instant FedNow® is a game-changer.

2) Cost: Instant FedNow® Eliminates Credit Card Processing Fees

Credit card transactions come with multiple hidden costs:

- Interchange fees (1.5%–3.5%) per transaction.

- Gateway & processing fees from third-party payment processors.

- Chargeback penalties, costing businesses additional money.

Instant FedNow® eliminates these

unnecessary costs because:

✅ There are no

interchange fees—FedNow® enables direct bank-to-bank

transfers.

✅ Businesses save thousands per year

by avoiding processing fees.

✅ No need for

costly payment gateways like Stripe, Square, or PayPal.

By switching to Instant FedNow®, businesses can retain more revenue, rather than paying excessive transaction fees to credit card companies.

3) Security & Chargebacks: Instant FedNow® is Safer for Businesses

Chargebacks are a major risk for businesses that accept credit cards. Customers can dispute transactions for months, leading to financial loss, increased fees, and fraud.

With

Instant FedNow®, transactions

are:

✅ Final and irrevocable—once

processed, they cannot be reversed.

✅

More secure than credit cards, as transactions use direct

bank authentication.

✅ Protected from fraud,

since funds must be available at the time of transfer.

This means businesses are no longer at risk of fraudulent chargebacks, which are common in industries like e-commerce, consulting, and digital services.

4) Customer & Business Benefits: Why FedNow® is the Future of Payments

Credit cards are convenient, but Instant FedNow® provides greater efficiency and cost savings for both businesses and consumers:

For Businesses:

✅ Get paid instantly—no

more waiting for settlement delays.

✅ Reduce

operating costs—eliminate transaction fees.

✅

Enhance security—no risk of chargebacks or credit card

fraud.

✅ Improve cash flow management—funds

are available immediately.

For Consumers:

✅ Pay directly from bank

accounts—no reliance on credit card debt.

✅

Better budgeting—instant payments mean no surprise charges

later.

✅ Stronger security—no exposure to

stolen credit card information.

With **Instant FedNow®, businesses and customers can benefit from a modern, real-time payment system that eliminates the inefficiencies of credit card processing.

5) Why Businesses Should Transition to Instant FedNow®

Credit card processing is expensive, slow, and risky for merchants. Instant FedNow® offers a streamlined, cost-effective, and secure alternative that allows businesses to retain more of their revenue while providing customers with a fast, seamless payment experience.

As the payment industry moves toward real-time banking transactions, businesses should start integrating Instant FedNow® as an alternative to traditional card payments to remain competitive.

���� Start accepting Instant FedNow® today and future-proof your business with real-time payments!

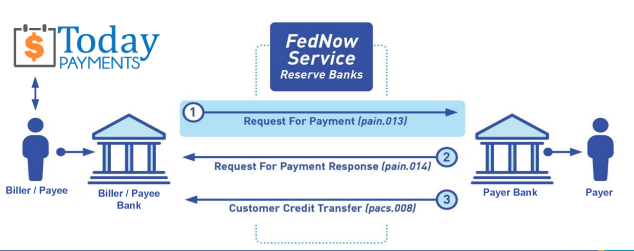

Creation Request for Payment Bank File

Enhance Your Instant FedNow using Credit Cards Payment Requests with FedNow’s ISO 20022 Messaging

Streamline Payments with Advanced Request for Payment Options:

Harness the power of FedNow's Request for Payment system to transform how you manage invoices and remittances. Our platform supports diverse data integration options, allowing payees to incorporate detailed invoice data directly within the RfP message or link to a comprehensive Merchant Page.

Flexible Invoice Details with ISO 20022 Messaging:

Leverage the flexibility of ISO 20022 messaging standards in our RfP system. You can choose to display crucial payment details directly in the message with a concise 140-character description, or through a dynamic "Hyper-Link" leading to a detailed Merchant Page. This Merchant Page can be hosted either on your website or TodayPayments.com/HostedPaymentPage.html through our seamless integration solution.

Customizable Merchant Pages for Enhanced Customer Experience:

Create a Merchant Page that not only details all the MIDs you own but also presents these options attractively to your customers through the RfP. This customization ensures that whether your payer opts for Real-Time Payment, Same-Day ACH, or Card transactions, they can easily navigate and complete their payments through a simple click on the hyperlink provided on your Merchant Page.

Call us today and receive the .csv or .xml FedNow® or Request for Payment (RfP) file you need—all during your very first phone call! We guarantee that our comprehensive reports integrate flawlessly with your bank or credit union. As pioneers in recognizing the benefits of RequestForPayment.com, we have stayed years ahead of our competitors. Although we are not a bank, our role as an "Accounting System" within the Open Banking ecosystem enables us to work with billers to create effective RfP files that seamlessly upload to the biller's online banking platform. U.S. companies rely on our expertise to learn how to deliver the RfP message directly to their bank with precision.

Our advanced solution, Today Payments' ISO 20022 Payment Initiation (PAIN.013), demonstrates how to create a Real-Time Payments Request for Payment file that sends a clear message from the creditor (payee) to its bank. Most financial institutions support the import of messaging and batch files for both FedNow® and Real-Time Payments (RtP), ensuring smooth processing. Once the file is correctly uploaded, the creditor’s bank processes the payment through a secure "Payment Hub"—with The Clearing House serving as the RtP Hub—and relays the message to the debtor's (payer's) bank. This streamlined approach not only accelerates transaction processing but also enhances transparency and reliability for all parties involved.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Contact Us for Request For Payment payment processing